New data from CoreLogic suggests we might be near the end of the housing downturn.

While Australia’s median property price fell 0.1% during February, values then rose in some markets in the four weeks to March 15:

• Sydney – up 0.8%

• Melbourne – up 0.2%

• Perth – up 0.1%

• Brisbane – unchanged

• Adelaide – down 0.4%

That said, it’s too early to call the bottom of the market, according to CoreLogic’s executive research director, Tim Lawless.

“Interest rates may rise further from here, as well as the fact that we are yet to see the full impact on households from the aggressive rate hiking cycle to date,” he said.

“Additionally, economic conditions are set to weaken through the middle of the year, as household savings buffers are being depleted and labour markets are likely to loosen further.”

Mr Lawless said one of the key metrics to watch would be the flow of new property listings, as a relative increase in supply would lead to a relative decrease in demand, and “could be a signal this recent trend of growth has run out of steam”.

First home buyers now need less time to save a deposit

Over the past year, it’s become significantly easier for first home buyers to save a 20% house deposit, according to new research from Domain.

In February 2022, first home buyers needed an average of 5 years 5 months to save a 20% house deposit. By February 2023, that had fallen to 4 years 11 months.

It’s also become easier for first home buyers to save a 20% unit deposit, with the average time falling from 3 years 9 months to 3 years 7 months.

Domain calculated the average income and purchase price of first home buyers by assuming they were a couple aged between 25-34 years and were purchasing an entry-level property.

The reason first home buyers now need less time to save a deposit is because property prices have fallen over the past year, which means the deposit requirement has also fallen.

We love helping first home buyers enter the market. If you want to buy your first home (or your children do), reach out today so I can explain the options.

RBA “closer to the point” where it will stop hiking rates

Reserve Bank of Australia (RBA) governor Philip Lowe has hinted that with monetary policy now in “restrictive territory”, interest rates may be near their peak.

In a speech delivered the day after the RBA raised the cash rate for the 10th consecutive time, Governor Lowe said the RBA Board was closely monitoring the effect of all those earlier rate rises.

“At our Board meeting yesterday, we discussed the lags in monetary policy, the effects of the large cumulative increase in interest rates since May and the difficulties that higher interest rates are causing for many households. We also discussed that, with monetary policy now in restrictive territory, we are closer to the point where it will be appropriate to pause interest rate increases to allow more time to assess the state of the economy,” he said.

However, Governor Lowe also said inflation was “still too high” and that “further tightening of monetary policy is likely to be required” to quash inflation within a reasonable timeframe.

“If we don’t get inflation down fairly soon, the end result will be even higher interest rates and more unemployment,” he said.

Home owners reluctant to list their properties for sale

The number of properties listed for sale has increased, although this is due to fewer new listings coming onto the market than existing listings taking longer to sell.

SQM Research has reported that 231,039 properties across Australia were listed for sale in February, which was 7.7% higher than the year before.

Significantly, though, the number of new listings (those less than 30 days old) in February was 11.0% lower than the year before. Conversely, the number of old listings (those greater than 180 days) was 30.3% higher.

SQM managing director Louis Christopher said relatively few owners wanted to sell – or to set a price that met the market.

“This clearly reveals itself by the lower-than-average counts of new stock entering the market for February and what sellers are there, continue to hold the line on their asking price,” he said.

“But sellers do need to understand the market is unlikely to catch up to their asking price at this present point in time. Only a minority of sellers recognise this, hence why there has been a rather large rise in older listings.”

If you are buying, re-financing or have any questions, contact me on the below information.

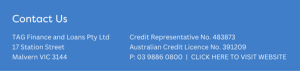

TAG Finance and Loans

TAG Finance and Loans

Sal Cinque | CEO

03 9886 0800 | loans@tagfinancial.com.au

Disclaimer: The information contained on this page is general in nature. Professional advice should be sought before acting on any aspect on this page. TAG Finance and Loans Pty Ltd ABN 25 609 906 863 Credit Representative Number 483873 National Mortgage Brokers Pty Ltd ABN 88 093 874 376 Australian Credit License 391209.