The Reserve Bank of Australia (RBA) has held the cash rate steady at 4.35% following its board meeting on Tuesday. The last time the RBA changed the cash rate was an increase in November 2023.

The Reserve Bank of Australia (RBA) has held the cash rate steady at 4.35% following its board meeting on Tuesday. The last time the RBA changed the cash rate was an increase in November 2023.

Holding the cash rate at 4.35% was widely expected as the RBA made it clear it is working on returning inflation within the target range of 2-3%. While inflation has fallen since its peak, the most recent quarterly results for June 2024 showed it is still above target at 3.8%.

In a keynote address earlier this month, RBA governor Michele Bullock said, “The Board remains vigilant to upside risks to inflation and has noted that monetary policy will need to remain sufficiently restrictive until it is confident that inflation is moving sustainably towards the target range.”

She added that if the economy moves generally as predicted, it is unlikely there will be a rate cut in the near term – full statement here.

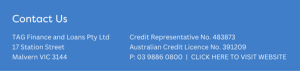

Contact TAG Finance and Loans if you’d like to discuss the current interest rate environment, and how it may affect your current loan or future borrowing plans or if you.

Want to pay less on your home loan?

TAG Finance and Loans

TAG Finance and Loans

Sal Cinque | CEO

03 9886 0800 | loans@tagfinancial.com.au

Disclaimer: The information contained on this page is general in nature. Professional advice should be sought before acting on any aspect on this page. TAG Finance and Loans Pty Ltd ABN 25 609 906 863 Credit Representative Number 483873 National Mortgage Brokers Pty Ltd ABN 88 093 874 376 Australian Credit License 391209.