With many people coming off fixed rates right now, it’s no surprise that an enormous amount of refinancing is occurring, as borrowers look to switch to lower-rate loans.

The latest Australian Bureau of Statistics (ABS) data has revealed that borrowers refinanced $20.60 billion of loans in August – which was 3.9% lower than the month before but 12.4% higher than the year before.

Meanwhile, the ABS also revealed that the value of all new home loan commitments in August was $24.82 billion, which was 2.2% higher than the month before.

Owner-occupier borrowing rose 2.6% to $16.07 billion, while investor borrowing rose 1.6% to $8.75 billion.

That said, home loan activity has fallen on a year-on-year basis:

- Total borrowing down 9.4%

- Owner-occupier down 12.5%

- Investor down 3.0%

The interest rate environment has changed significantly, and the level of competition in the mortgage market is fierce, so there are many great refinancing deals available – including with quality smaller lenders you may be unfamiliar with.

How interest rates have evolved over the past 18 months

The latest Reserve Bank of Australia (RBA) data has shown the impact the RBA’s cash rate rises have had on the mortgage market.

The key is to compare average interest rates for all outstanding loans in April 2022 – the month before the first rate rise – and August 2023 – the most recent month for which we have data.

During that time, the RBA increased the cash rate by 4.00 percentage points. Interest rates for outstanding loans have, on average, increased by less than that amount, in part because some loans were fixed at lower rates.

For owner-occupied loans, rates have increased by an average of:

- 2.82 percentage points for principal-and-interest loans

- 3.31 percentage points for interest-only loans

For investment loans, rates have increased by:

- 2.83 percentage points for principal-and-interest loans

- 2.73 percentage points for interest-only loans

Future interest rate hikes can’t be ruled out. The conflict in the Middle East may lead to higher oil prices, and therefore higher petrol prices and higher inflation. In the RBA’s cash rate meeting earlier this month, board members noted that “some further tightening of policy [i.e. rate rises] may be required should inflation prove more persistent than expected”, according to the meeting minutes.

How the federal government is helping first home buyers

A new report, from Housing Australia, has revealed that about one in three of all first home buyers in the 2022-23 financial year used the federal government’s Housing Guarantee Scheme (HGS) and its three different assistance programs.

Here’s what the typical participant looked like, according to Housing Australia:

1. First Home Guarantee: the median participant was in the 30-34 age bracket, had a household income of $76,000 and bought a property worth $459,000.

2. Regional First Home Buyer Guarantee: participants were aged 25-29, earned $71,000 and bought a $389,000 home.

3. Family Home Guarantee (for single parents): participants were aged 35-39, earned $70,000 and bought a $422,000 home.

Meanwhile, Housing Australia is the name of the new agency that has just replaced the National Housing Finance and Investment Corporation and assumed its responsibilities.

Housing Australia has not only taken control of the HGS, but also the National Housing Infrastructure Facility, which provides loans and grants for critical infrastructure to unlock and accelerate new housing supply.

RBA increases cash rate to 4.35%

On the back of recent concerning data around inflation, the Reserve Bank of Australia (RBA) increased the cash rate from 4.10% to 4.35%.

The decision was in line with market expectations, given the RBA recently said it would “not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation” – Read the full statement here.

With the interest rate picture looking uncertain, it can help to talk to an expert.

If you are buying, re-financing or have any questions, contact me on the below information.

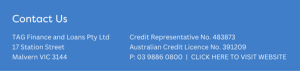

TAG Finance and Loans

TAG Finance and Loans

Sal Cinque | CEO

03 9886 0800 | loans@tagfinancial.com.au

Disclaimer: The information contained on this page is general in nature. Professional advice should be sought before acting on any aspect on this page. TAG Finance and Loans Pty Ltd ABN 25 609 906 863 Credit Representative Number 483873 National Mortgage Brokers Pty Ltd ABN 88 093 874 376 Australian Credit License 391209.