Property investors have been put on notice, after the Australian Taxation Office (ATO) said it would scrutinise their tax returns in an attempt to claw back an estimated $1.3 billion in missing taxes.

The ATO told The Guardian that it would use “formal information gathering powers” to compel 17 financial institutions – including all the big four banks – to provide data on approximately 1.7 million property investors.

That would allow the ATO to assess all the income an investor had earned and all the expenses they’d incurred over the course of a year, and to then compare that with their tax return.

According to the ATO, the most common tax mistakes that property investors make are:

- incorrectly declaring improvements to be repairs rather than capital works

- not apportioning expenses for private use of the property

- either not apportioning or incorrectly apportioning the loan interest costs after refinancing for private purposes

That’s why it’s generally a good idea for property investors to get professional help when filing tax returns. If you’d like to be introduced to a trusted accountant, reach out and we’d be happy to recommend someone.

Property downturn may be over

Australian property prices rose 0.6% in March, according to CoreLogic – the first monthly increase since April 2022.

But while prices increased at a national level, and in Sydney, Melbourne, Perth and Brisbane as well, they did decline in the four smaller capitals.

CoreLogic’s research director, Tim Lawless, said one reason prices are rising again is due to the tight rental market, where accommodation is scarce, and rents are rising rapidly.

That’s motivating some tenants to switch from renting to buying, thereby increasing buyer demand.

“Similarly, with net overseas migration at record levels and rising, there is a chance more permanent or long-term migrants who can afford to, will skip the rental phase and fast track a home purchase simply because they can’t find rental accommodation,” he said.

Refinancing activity keeps on going from strength to strength

The home loan refinancing boom, which has lasted for two years and counting, has reached record levels.

Refinancing activity has dramatically increased during that time from $13.7 billion in February 2021 to $16.2 billion in February 2022 and according to the latest Australian Bureau of Statistics data, a record $19.9 billion in February 2023.

The refinancing surge started in 2021 when interest rates were at record-low levels – at that point, many borrowers refinanced so they could lock in ultra-low fixed rates.

The surge was given fresh life in May 2022 when the Reserve Bank started raising rates – many borrowers then refinanced to lower-rate loans to ‘cancel out’ rate rises.

There’s no doubt the mortgage market has changed a lot in a short amount of time. So if it’s been at least two years since you refinanced, there’s a good chance your interest rate is unnecessarily high. Our suggestion is to book an appointment so we can review your loan to see if you can secure a better deal.

How to protect yourself against scams

The Australian Banking Association (ABA) has launched a new campaign to raise awareness about scams.

This is a very topical issue, with Scamwatch receiving 14,603 reports about bank impersonation scams in 2022, resulting in more than $20 million in losses, according to the Australian Competition & Consumer Commission.

The ABA ads include these key messages:

Bank impersonation scams:

- “Banks will never call you and ask you to transfer money to another account.”

- E-toll scams: “Never click on suspicious texts, links or emails.”

- Investment scams: “Always check you’re dealing with a legitimate organisation.”

- Invoice scams: “Never transfer money unless you’re certain it’s to the right person.”

Banks will never:

- Ask you to transfer funds to another account over the phone

- Send you unsolicited texts or emails that ask you to provide your account or personal details

- Ask for online banking passcodes or passwords over email, text or phone

- Ask for remote access to your computer

- Threaten to take immediate action on an issue

The ABA has advised consumers to question the authenticity of texts, emails or calls from people who claim to be from a bank or trusted organisation. The ABA has also highlighted the importance of registering a PayID (only through a bank, not a third party) and using it when available.’

Consumers should also set up two-factor authentication for online banking, check the legitimacy of invoices or bills, and report any suspicious activity to their bank.

If you are buying, re-financing or have any questions, contact me on the below information.

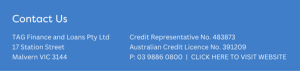

TAG Finance and Loans

TAG Finance and Loans

Sal Cinque | CEO

03 9886 0800 | loans@tagfinancial.com.au

Disclaimer: The information contained on this page is general in nature. Professional advice should be sought before acting on any aspect on this page. TAG Finance and Loans Pty Ltd ABN 25 609 906 863 Credit Representative Number 483873 National Mortgage Brokers Pty Ltd ABN 88 093 874 376 Australian Credit License 391209.