Author: Sal Cinque, CEO, TAG Finance & Loans

As part of the second stimulus package, the Federal Government announced the COVID-19 SME Guarantee Scheme. Under the scheme, the Government guarantees 50% of new loans issued by eligible lenders to SMEs for working capital purposes.

The main parameters are:

- Unsecured loans up to $250k per business

- Available to businesses with less than $50m annual turnover

- Interest rate approximately 4% p.a. lower than standard unsecured business loans

- No repayments required for the 1st 6 months – interest capitalised during this time

- Principal & interest repayments will be required from month 7

- Repayments will be calculated to fully amortise the loan at the end of the 3 year term

- Applications subject to lenders’ credit assessment processes

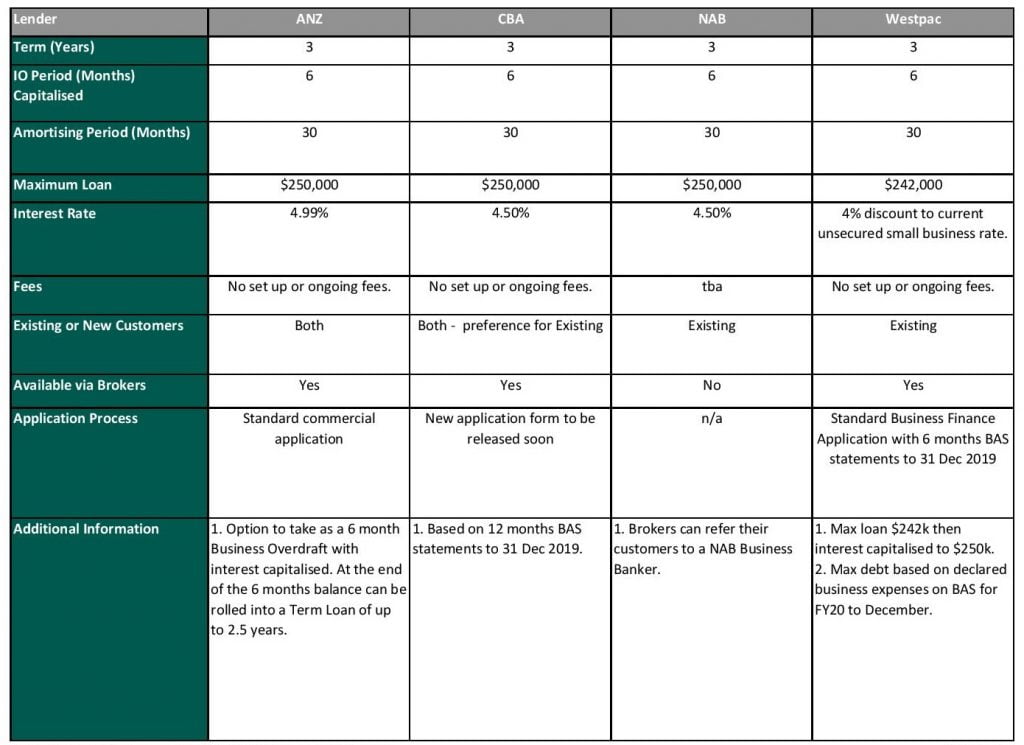

The following matrix details the Federal Government’s SME Loan Scheme offering from the 4 main banks:

Federal Government COVID-19 SME Guarantee Loan Scheme

Eligibility: Annual turnover <$50m

NOTE: Subject to change and should be used as a guide only. 9-Apr-20

If you wish to apply for a loan, speed-to-funding will be best achieved via your existing bank where trading accounts can be easily reviewed.

Please don’t hesitate to reach out if we can assist by calling 03 9886 0800 or emailing loans@tagfinancial.com.au.

Disclaimer: The information contained on this page is general in nature. Professional advice should be sought before acting on any aspect on this page. TAG Finance and Loans Pty Ltd ABN 25 609 906 863 Credit Representative Number 483873 National Mortgage Brokers Pty Ltd ABN 88 093 874 376 Australian Credit License 391209.